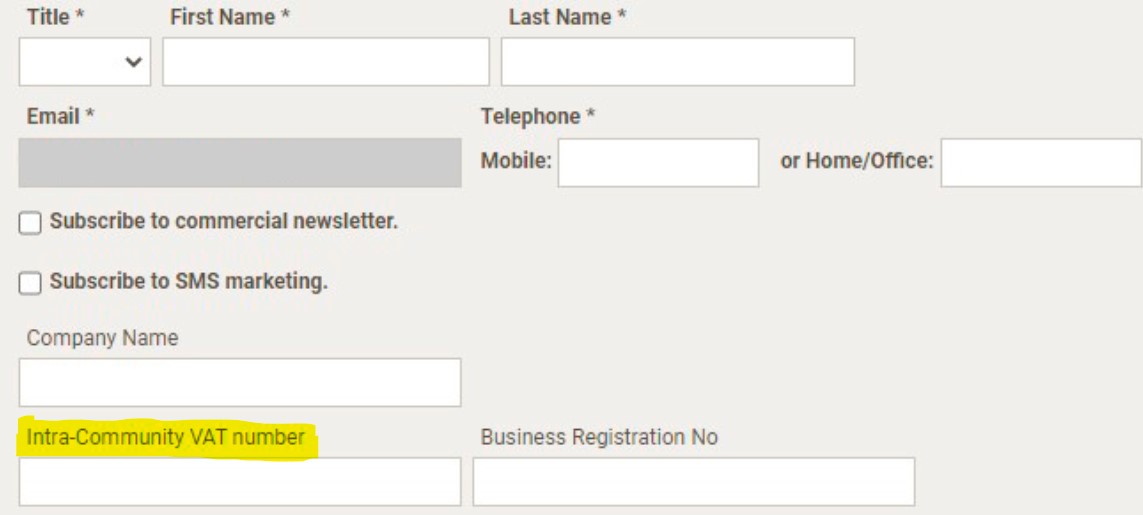

INTRA-COMMUNITY VAT If you live in a country of the European Union other than Spain and you are registered in the intra-community VAT system, you can now pay for your order directly without VAT. To do this, you must enter your valid intra-community number in the "Intra-community VAT" box found in the 'Update contact information and preferences' section of your user account. Once the number is entered, the prices will be displawe without VAT on the website.  Once you have processed your order, we will verify the provided number and, in the event of any incident or error, we will contact you to solve the situation it before shipping the order. If, on the contrary, everything is correct, we will proceed with the shipment as soon as possible. If you are not registered in the European VIES system, we invite you to contact the tax authorities of your country to obtain more information and to be able to register. HERE you can check if you are registered in the European Union system. Otherwise, if you do not enter any valid number in the aforementioned box, the prices will be shown includin the VAT percentage corresponding to the country that you have registered in your profile. If you are not logged in, the VAT applied will be the Spanish 21%. EUROPEAN VAT In accordance with the new applicable European regulations, as of July 1st, 2021, each order processed in our online store will be taxed with the VAT percentage corresponding to the country from which the purchase is made. The prices shown on our website include the 21% Spanish VAT. When you create an account and enter your details, the VAT will be adjusted to the percentage for your country. Consequently, the price of the items may change depending on the type of VAT that is applied in your country. We are sorry for all the inconveniences that this new regulation by the European Union may cause you. If you have an intra-community VAT number, we will continue to refund the amount corresponding to the VAT you pay. |